Analyst Expectations For Patterson-UTI Energy's Future

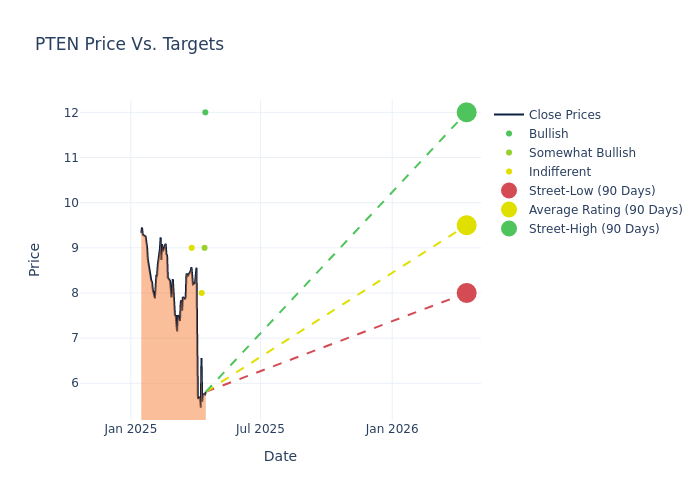

4 analysts have expressed a variety of opinions on Patterson-UTI Energy (NASDAQ:PTEN) over the past quarter, offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

In the assessment of 12-month price targets, analysts unveil insights for Patterson-UTI Energy, presenting an average target of $9.5, a high estimate of $12.00, and a low estimate of $8.00. This current average has decreased by 13.64% from the previous average price target of $11.00.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Patterson-UTI Energy. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Stephen Gengaro |Stifel |Lowers |Buy | $12.00|$13.00 | |Charles Minervino |Susquehanna |Lowers |Positive | $9.00|$10.00 | |Ati Modak |Goldman Sachs |Lowers |Neutral | $8.00|$11.00 | |Daniel Kutz |Morgan Stanley |Lowers |Equal-Weight | $9.00|$10.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Patterson-UTI Energy. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Patterson-UTI Energy compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Patterson-UTI Energy's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Patterson-UTI Energy's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Patterson-UTI Energy analyst ratings.

Unveiling the Story Behind Patterson-UTI Energy

Patterson-UTI Energy Inc is one of the substantial land rig drilling contractors in the United States. Its 2023 merger with NexTier greatly expanded its pressure pumping operations, as well, and the firm now controls nearly 20% of the North American market for drilling and completions services. The company operates under three reportable business segments: (i) drilling services, (ii) completion services, and (iii) drilling products. It also provides directional drilling services and tool rental services in united states onshore oil and gas basins.

Understanding the Numbers: Patterson-UTI Energy's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Decline in Revenue: Over the 3M period, Patterson-UTI Energy faced challenges, resulting in a decline of approximately -26.65% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -4.44%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Patterson-UTI Energy's ROE stands out, surpassing industry averages. With an impressive ROE of -1.47%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Patterson-UTI Energy's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.87%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.37.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.